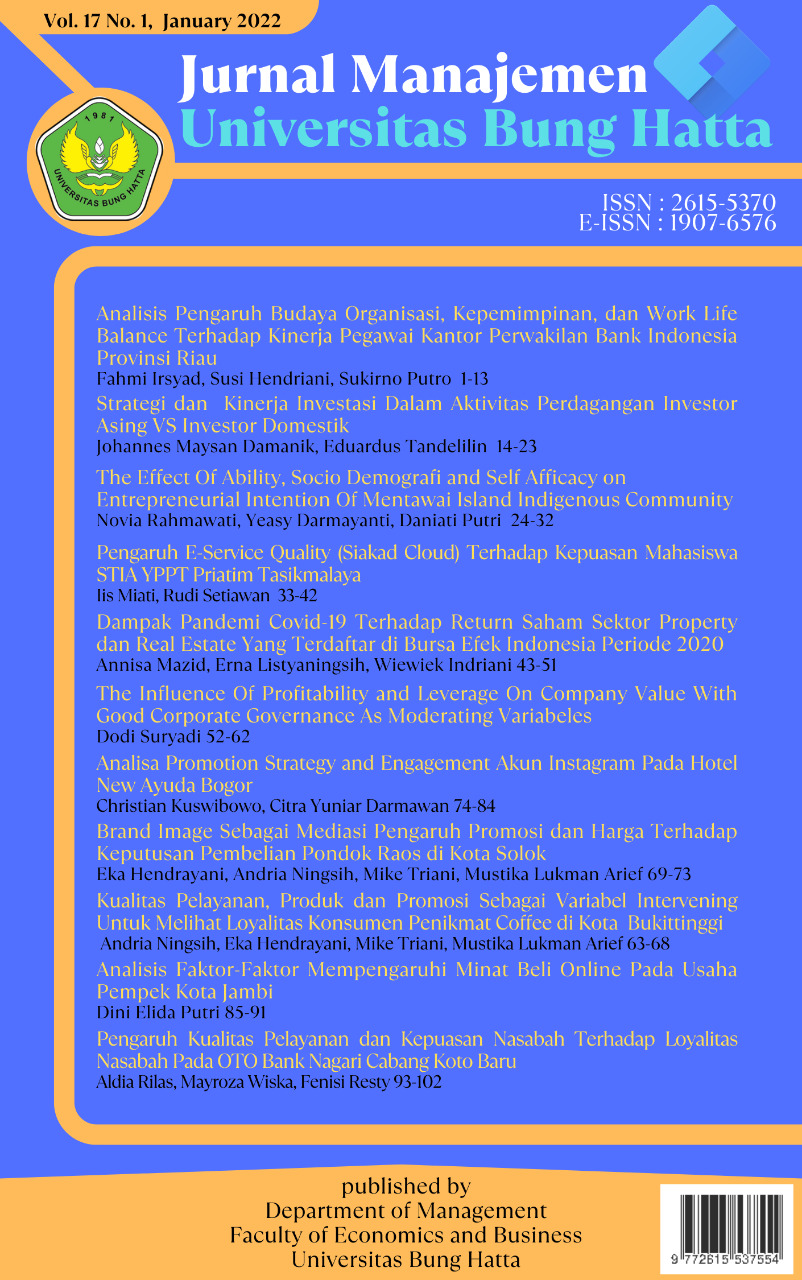

STRATEGI DAN KINERJA INVESTASI DALAM AKTIVITAS PERDAGANGAN INVESTOR ASING VS INVESTOR DOMESTIK

DOI:

https://doi.org/10.37301/jmubh.v17i1.19997Abstract

This study is aimed to find out the investment strategy and investment performance betwen foreign investrors and domestics investror who have transaction in Indonesia Stock Excange. A Proxy used to see the Investment Strategy and Investment Performance in this study is the Trading Profit from transaction wich has been done by the investors. Investment strategy chossen bt investors can be seen from the investor’s tendency in doing some sales which contains some shareds with positive and negative valued trading profit. Investment Performance is seen from the investor’s capability in producing positive valued trading profit. This study used intra-day transaction data which are transacted by foreign investors and domestic investors. The result of this study found that foreign investors used a momentum when transacting in the stock excange and domestics investor using a contrarian when transacting in the stock excange. This study olso found that there isn’t defferent performance between foreign investors and domestik investors in stock excange transactions activities.

References

Agarwal, Sumit, Sheri Faircloth, Chunlin Liu, and S. Ghon Rhee. 2009. “Why Do Foreign Investors Underperform Domestic Investors in Trading Activities? Evidence from Indonesia.” Journal of Financial Markets 12(1): 32–53.

Barber, Brad M, Yi-Tsung Lee, Yu-Jane Liu, and Terrance Odean. 2004. Who Gains from Trade? Evidence from Taiwan. www.gsm.ucdavis.edu/~bmbarber.

de Bondt, Werner F M, and Richard Thaler. 1985. “Does the Stock Market Overreact?” Source: The Journal of Finance 40(3): 793–805.

Chiang, Sue Jane, Li Ju Tsai, Pei Gi Shu, and Show Lin Chen. 2012. “The Trading Behavior of Foreign, Domestic Institutional, and Domestic Individual Investors: Evidence from the Taiwan Stock Market.” Pasific-Basin Finance Journal 20(5): 745–54.

Choe Hyuk, Bong-Chan Kho, René M. Stulz. 2001. “Do Domestic Investors Have More Valuable Information About Individual Stocks than Foreign Investors?” NBER Working Paper No. w8073.

Eduardus Tandelilin. 2001. Analisis Investasi Dan Manajemen Risiko. Pertama. Yogyakarta: BPFE.

Ika Yustina Rahmawat, Dr. Eddy Junarsin, Mba. 2015. “Pengujian Kembali Strategi Kontrarian Di Bursa Efek Indonesia.”

Imam Ghozali. 2014. Statistik Non-Parametrik Teori Dan Aplikasi Dengan Program SPSS. Semarang: Badan Penerbit Universitas Diponegoro.

Mamduh Hanafi, S. Ghon Rhee. 2004. “The Wealth Effect of Foreign Investor Presence: Evidence from the Indonesian Market.” Management International Review Vol. 44, No.2,: 157–71.

Muninggar, Dyah Retno, Dr. Mamduh M. Hanafi, MBA. 2009. “Kinerja Dan Strategi Investasi Antara Investor Asing Dan Domestik Di Bursa Efek Indonesia .”

Ni Luh Putu Wiagustini. 2008. “Profitabilitas Strategi Investasi Kontrarian Di Bursa Efek Indonesia.” Jurnal manajemen dan Kewirausahaan 10(2): 105–14.

Rouwenhorst K. Geert. 1998. “International Momentum Strategies on JSTOR.” The Journal of Finance 53(1): 267–84.

Tomáš Dvořák. 2005. “Do Domestic Investors Have an Information Advantage? Evidence from Indonesia on JSTOR.” The Journal of Finance : 817–39.

Downloads

Published

Issue

Section

License

Copyright (c) 2022 Johannes Maysan Damanik, Eduardus Tandelilin

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with Jurnal Manajemen Universitas Bung Hatta agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Creative Commons Attribution-ShareAlike 4.0 International License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in Jurnal Manajemen Universitas Bung Hatta.

- The author holds the copyright of the submitted and published articles, with the understanding that articles are disseminated under the Creative Commons Attribution-ShareAlike 4.0 International License..

- The editor team is entitled to do the editing in accordance with the guidelines for writing or template in the Jurnal Manajemen Universitas Bung Hatta.

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.